#Invoice Management System

Explore tagged Tumblr posts

Link

2 notes

·

View notes

Text

Orange Blue Minimalist Business Invoice A4 Document

Orange Blue Minimalist Business Invoice A4 Document is a vibrant and modern template designed for businesses that value clarity and style. Featuring a clean layout with orange and blue accents, it balances professionalism with a touch of creativity.

Buy this

#free invoice software#invoice software development bd#money transfer#finance#money#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

2 notes

·

View notes

Text

Tackling Cart Abandonment with Digital Payment Solutions

Cart abandonment is a prevalent challenge in the e-commerce landscape, with studies indicating that nearly 70% of online shoppers leave their carts without completing a purchase. A significant contributor to this issue is a complicated or inefficient payment process.

Leveraging Digital Payment Solutions

Implementing advanced digital payment solutions can address these issues and enhance the customer experience:

Seamless Online Payment Gateways: Offering a user-friendly payment gateway ensures quick and secure transactions. Features like one-click payments and mobile optimization can significantly reduce checkout time.

Multiple Payment Methods: Providing various payment options, including credit/debit cards, UPI, mobile wallets, and Buy Now, Pay Later (BNPL) services, caters to diverse customer preferences and reduces the likelihood of cart abandonment.

E-Invoicing Solutions: Instant invoice generation and automated payment reminders can reassure customers and encourage them to complete their purchases.

Optimized Checkout Experience: Simplifying the checkout process by minimizing form fields, offering guest checkout options, and ensuring fast processing times can enhance user satisfaction and reduce drop-offs.

For a deeper dive into this topic, check out the full article here: How Digital Payment Solutions Can Reduce Cart Abandonment

#digital payments#payment processing#payment gateway#online payments#payomatix technologies#payment solution#ecommerce#cart abandonment#business growth#fintech#digital payment#invoice management system

0 notes

Text

𝗛𝗼𝘄 𝘁𝗼 𝗨𝘀𝗲 𝗮 𝗙𝗿𝗲𝗲 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗧𝗲𝗺𝗽𝗹𝗮𝘁𝗲 𝗶𝗻 𝗚𝗼𝗼𝗴𝗹𝗲 𝗗𝗼𝗰𝘀: 𝗔 𝗦𝘁𝗲𝗽-𝗯𝘆-𝗦𝘁𝗲𝗽 𝗚𝘂𝗶𝗱𝗲 This article is a comprehensive guide on how to create professional invoices using a free Google Docs template. It walks you through every step, from customizing the template to adding client details, listing products or services, and saving the final document. Perfect for small businesses and freelancers, this guide helps you streamline your invoicing process in just minutes. Discover how easy it is to get started—read the article now!

#business#finance#entrepreneurship#startup#google docs#invoice generator#invoice maker#free invoice software#invoice management system

1 note

·

View note

Text

Discover how you can automate invoice data extraction using AlgoDocs AI and save time and resources. Read our comprehensive guide to learn more.

#ocr#algodocs#imagetoexcel#ocralgorithms#ai tools#pdfconversion#tableextraction#dataextraction#invoice automation#invoice management system

0 notes

Video

youtube

Invoice Management System (IMS) Dashboard| IMS filing Accept, Reject, Pending & generate GSTR-2B

Simplifying Invoice Management | IMS Filing: Accept, Reject, Pending & GSTR-2B

📋 Learn how to efficiently manage invoices with the Invoice Management System (IMS)! In this video, we cover: ✅ How to accept, reject, and track pending invoices in IMS. 🛠️ Steps to generate and reconcile GSTR-2B for accurate GST filing. 📈 Tips to ensure smooth compliance and avoid mismatches in GST returns.

Whether you're a business owner, accountant, or GST practitioner, this guide simplifies the complexities of invoice management and GSTR-2B reconciliation.

📌 Don't forget to like, comment, and share your thoughts below! 💡 Subscribe for more GST and accounting insights.

0 notes

Text

Invoice Software | Invoice Management System

#billing software#invoice software#invoice tracking software#invoice automation#invoice management system#invoice management software

0 notes

Text

Invoice Management tips for Small Businesses

In a commercial transaction, you cannot avoid charges. Whenever a business sells goods or services to a consumer or customer, a transaction is usually followed by an invoice. An invoice states the total cost a customer has to pay for goods or services.

The invoice will also include the total amount owed. Any settlement between the parties may result in your payment being delinquent. This can have a negative impact on the company's cash flow. Your ability to pay off your debts on time can also be affected by accounting issues.

Here are some of the invoice management tips and features for small businesses as below:-

Cloud-Based

Most of the modern business is accessible through the cloud. This means you can access the data for different users at the same time, from any location or any device. This allows users to work remotely as per convenience as result owners/consumers can access and use the data at the same time.

Live Data Tracing

If you want to know where your company stands i.e. profit or loss it can be known by tracing the live data of your employees. TRIRID-Billing software helps you to solve all your business problems.

Reduces Errors

Some of the most common billing mistakes done by small enterprises are receiving expenses from customers like purchase, sales, invoice etc. While using proper billing software always catch every single mistake to improve business growth.

Business Intelligence

If you are using the old conventional methods like spreadsheets and other tools for optimizing business transactions, there is a high possibility occurring of human errors from your side and other side. To overcome all these problems, choosing a right billing software for your business is the best solution.

Increased Accuracy and Performance

Automated billing software can analyse expenses to identify and removing errors, like duplicates and overpayments while done manually. This detailed data analysis is extremely useful for small, medium and large enterprises that deal in multiple taxes as VAT, GST etc. To overcome all these problems, choosing a right billing software for your business is the best solution.

Rapid Invoices Generating

TRIRID-Billing Software is deal with the bill payment of Purchases, Sales and other transactions that can be easily achieved by using our billing software. So you can send emails to clients once invoice is generated as per convenience and print receipts whenever necessary.

Reduce Manual Processing

TRIRID-Billing software can help you eliminate inefficient and wasteful paper work without forcing your suppliers to completely change their current processes. Depending on the service, invoices can be emailed or shared electronically.

Rapid Invoices Generating

TRIRID-Billing Software is deal with the bill payment of Purchases, Sales and other transactions that can be easily achieved by using our billing software. So you can send emails to clients once invoice is generated as per convenience and print receipts whenever necessary.

Reporting Making

You can make generate report easily as your invoices can quickly and easily be organised by TRIRID-Billing software including date, type or any other fields you choose. This provide you clear-cut idea of your business’s projections, accounting, management many more.

Time-Saving

You can manage invoice once you have enter proper time so it is easy to move your data in a proper way. The TRIRID-Billing software is easy to use and take less time to generate receipt. It will automatically generate invoices for billing transactions, save your precious time. TRIRID-Billing software has integrated time saving features before emailing them to the customer.

For More Information:

Call @ +91 8980010210

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Benefits of Billing Software#Invoice Management System#What is Invoice Processing#TRIRID-Billing in Bopal-Ambli road-ahmedabad#TRIRID-Billing in ISCON-Ambli road-ahmedabad

0 notes

Text

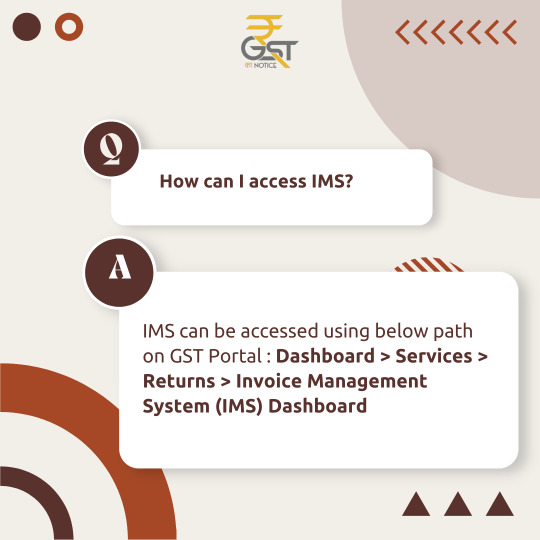

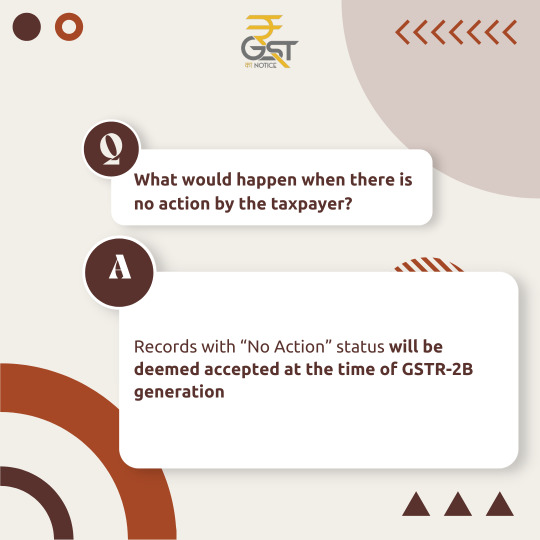

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

Invoicing management software streamlines the process of creating, sending, and tracking invoices for businesses. It automates billing, ensuring accuracy and timely payments, reducing manual errors, and enhancing overall efficiency. Key features include customizable invoice templates, payment reminders, integration with accounting tools, and real-time tracking of financial data. This software is essential for businesses looking to save time, manage cash flow effectively, and maintain a professional financial operation.

#invoice management systems#online invoice management system#best invoice management software#invoicing management software#invoice management system#invoice management software

0 notes

Text

#invoice management system#billing and invoicing software#invoice accounting software#quotation and invoice software

0 notes

Text

Black White Bold Simple Photography Studio Invoice

Black White Bold Simple Photography Studio Invoice is a sleek and modern template tailored for photography professionals. Featuring a clean white background with bold black accents, it exudes sophistication and clarity.

Buy this

#free invoice software#invoice software development bd#money transfer#money#finance#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

0 notes

Text

Invoice Dispute Management: A Comprehensive Guide

Invoice disputes are an inevitable part of any business. Whether it's due to discrepancies in quantities, pricing errors, or service issues, these disputes can be time-consuming and frustrating for both parties involved. Effective invoice dispute management is crucial for maintaining healthy customer relationships and preserving cash flow. In this blog post, we will delve into the intricacies of invoice dispute management, providing you with practical strategies to streamline the process and minimize its impact on your business.

Understanding the Importance of Invoice Dispute Management

Prompt and efficient invoice dispute resolution is essential for several reasons. Firstly, it helps to maintain customer satisfaction by demonstrating a commitment to resolving issues promptly and fairly. Secondly, it safeguards your business's reputation by preventing disputes from escalating into negative reviews or public complaints. Lastly, effective dispute management contributes to improved cash flow by reducing the time it takes to collect outstanding payments.

Common Causes of Invoice Disputes

To effectively address invoice disputes, it's important to understand their common causes. Some of the most frequent reasons for disputes include:

Billing errors: Incorrect pricing, quantity discrepancies, or calculation mistakes.

Product or service issues: Quality problems, delivery delays, or incomplete orders.

Payment discrepancies: Disputes over due dates, payment terms, or payment methods.

Contractual disagreements: Misunderstandings or disagreements regarding contract terms and conditions.

Data entry errors: Incorrect customer information, billing address, or contact details.

Building a Robust Invoice Dispute Management Process

A well-structured invoice dispute management process is essential for handling disputes efficiently and effectively. Here are the key steps involved:

Establish clear dispute resolution procedures: Clearly outline the process for customers to submit disputes, including contact information and required documentation.

Designate a dedicated dispute resolution team: Assign a team responsible for handling disputes promptly and professionally.

Implement a dispute tracking system: Use a system to track and manage disputes, ensuring timely resolution and follow-up.

Conduct thorough investigations: Carefully review disputed invoices and gather necessary information to identify the root cause of the issue.

Communicate effectively with customers: Maintain open and transparent communication throughout the dispute resolution process, keeping customers informed of progress and updates.

Implement preventive measures: Analyze dispute data to identify common issues and implement corrective actions to prevent future disputes.

Tips for Effective Invoice Dispute Resolution

Respond promptly: Address disputes as soon as possible to prevent escalation and maintain customer satisfaction.

Be empathetic: Understand the customer's perspective and treat them with respect and understanding.

Provide clear explanations: Clearly communicate the reasons for the invoice and any necessary adjustments.

Offer alternative solutions: Explore options to resolve the dispute, such as refunds, credits, or replacements.

Document everything: Maintain detailed records of all communications and actions taken during the dispute resolution process.

By implementing a robust invoice dispute management process and following these tips, you can significantly improve customer satisfaction, protect your business reputation, and optimize cash flow. Remember, prevention is key, so invest in measures to minimize the occurrence of disputes in the first place.

0 notes

Text

Tired of manual invoice processing slowing down your organization's digital transformation journey? 𝗦𝘁𝗿𝗲𝗮𝗺𝗹𝗶𝗻𝗲 𝗬𝗼𝘂𝗿 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗣𝗮𝘆𝗮𝗯𝗹𝗲 𝘄𝗶𝘁𝗵 iKapture! We offer a best-in-class solution for Accounts Payable automation that eliminates manual data entry, streamlines workflows and unlocks valuable insights for your business. Here's how iKapture empowers your invoice processing: 👉Automated Invoice Processing 👉Enhanced Efficiency 👉Improved Accuracy 👉Real-Time Visibility 👉Seamless Integration Let iKapture transform your AP processes! Contact us today to learn more! #digitaltransformation #automation #documentprocessing #ai #accountspayable #invoiceprocessing

#ikapture#ai#ap automation#accounts payable#invoice management system#free invoice software#invoice processing

0 notes

Text

𝟭𝟮 𝗘𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗲𝗿𝗺𝘀 𝗘𝘃𝗲𝗿𝘆 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗦𝗵𝗼𝘂𝗹𝗱 𝗞𝗻𝗼𝘄 Understanding invoice payment terms is crucial for smooth business operations and timely cash flow management. This article outlines 12 essential payment terms that every business owner and entrepreneur should be familiar with. From "Net 30" to "Payment in Advance," these terms help establish clear expectations between you and your clients, ensuring transparency and efficiency. Ready to streamline your invoicing process and avoid payment delays? Dive into the full guide here!

#entrepreneurship#finance#business#startup#invoice#free invoice software#invoice maker#invoice management system#invoxa#invoice generator#invoice template#payments#payment systems

1 note

·

View note

Text

Understanding Petty Cash Expenses: A Guide for Small Businesses

Petty cash expenses refer to the small, everyday expenses incurred by a business that are typically paid out of a petty cash fund. This fund is a small amount of cash kept on hand for minor purchases or reimbursements, making it easier to manage and track small transactions without the need for formal accounting processes for each one. Proper management of petty cash is essential for maintaining accurate financial records and ensuring that these small expenses do not go unchecked. This guide will help you understand the importance, management, and tracking of Petty cash expenses in a small business setting.

Importance of Petty Cash

Convenience:

Petty cash provides a convenient way to handle minor expenses without going through the hassle of writing checks or processing electronic payments for every small transaction.

Efficiency:

It streamlines the process of making small purchases, such as office supplies, postage, or employee reimbursements, saving time and reducing administrative workload.

Control:

Having a petty cash fund allows for better control and monitoring of small, frequent expenses, ensuring they are recorded and accounted for correctly.

Common Petty Cash Expenses

Office Supplies:

Items like pens, paper, staplers, and other small office necessities.

Postage and Courier Services:

Costs associated with mailing letters, packages, or documents.

Employee Reimbursements:

Minor expenses incurred by employees that need to be reimbursed, such as travel fares or meal allowances.

Refreshments:

Small expenditures for office snacks, coffee, or tea.

Miscellaneous:

Any other small, irregular expenses that do not warrant a formal payment process.

Managing Petty Cash

Establish a Petty Cash Fund:

Decide on an appropriate amount for your petty cash fund based on your business needs. This amount should be sufficient to cover small expenses but not so large that it becomes difficult to manage.

Appoint a Custodian:

Assign a responsible individual to manage the petty cash fund. This person will be responsible for disbursing cash, keeping records, and ensuring the fund is balanced.

Set Policies and Procedures:

Develop clear policies for what can be purchased with petty cash, the maximum amount for individual transactions, and the process for documenting and approving expenses.

Record Keeping:

Maintain a petty cash log or ledger to record each transaction. The log should include details such as the date, amount, purpose, and the person receiving the cash. Require receipts for all disbursements to support the entries in the log.

Reconciliation:

Regularly reconcile the petty cash fund to ensure that the total amount of cash on hand plus the recorded expenses equals the original amount of the fund. This should be done monthly or whenever the fund is replenished.

Replenishment:

When the petty cash fund is low, replenish it by writing a check or making an electronic transfer for the amount spent. Ensure that all expenses are recorded before replenishment.

Benefits of Proper Petty Cash Management

Accurate Financial Records:

Proper management and documentation of petty cash expenses ensure that all business expenses are recorded accurately, contributing to reliable financial statements.

Prevention of Fraud:

Regular reconciliation and clear policies help prevent misuse or misappropriation of funds.

Budget Control:

Tracking petty cash expenses helps businesses monitor and control small expenditures, preventing them from adding up and impacting the overall budget.

Tax Compliance:

Proper documentation and recording of expenses ensure compliance with tax regulations and make it easier to claim deductions where applicable.

Conclusion

Petty cash expenses, though small, play a significant role in the day-to-day operations of a business. Effective management of petty cash funds ensures that these minor expenses are tracked, recorded, and controlled, contributing to overall financial health and operational efficiency. By establishing clear policies, maintaining accurate records, and regularly reconciling the fund, businesses can ensure that petty cash is used appropriately and effectively. Whether you run a small business or a larger enterprise, understanding and managing petty cash expenses is essential for smooth financial operations.

For more info. Visit us:

best expense reimbursement software

Best Expense Manager App India

expense tracker software

0 notes